TGB Stock Price Outlook: Navigating the Copper Market

Updated July 08, 2024

Introduction:

Taseko Mines Limited (TGB), a Canadian copper mining company, presents a compelling investment opportunity in the dynamic and growing copper market. With a strong portfolio of assets, including the Gibraltar Mine, the second-largest open-pit copper mine in Canada, and the innovative Florence Copper Project in Arizona, Taseko is well-positioned to capitalize on the increasing global demand for copper.

The Gibraltar Mine boasts a proven and probable reserve of 2.3 billion pounds of recoverable copper, with an estimated mine life of 23 years. The Florence Copper Project, currently in the permitting stage, is expected to produce an average of 85 million pounds of copper annually over its 21-year mine life using an in-situ copper recovery process, which minimizes environmental impact and maximizes resource efficiency.

Copper’s critical role in the global transition to clean energy and electric vehicles has driven a surge in demand. The International Energy Agency (IEA) projects that the demand for copper will nearly double by 2040, reaching 60 million tonnes per year. This growth is primarily driven by the increasing adoption of electric vehicles, which require up to four times more copper than conventional vehicles, and the expansion of renewable energy infrastructure, such as solar and wind power.

Despite the growing demand, the global copper supply is facing challenges. Declining ore grades, operational disruptions, and the lack of new mining projects have led to concerns about a potential supply deficit. Taseko’s solid asset base and ongoing exploration efforts position the company to help bridge this gap and benefit from the rising copper prices.

From a contrarian perspective, Taseko Mines presents an attractive investment opportunity. The company’s TGB stock may not fully reflect its long-term potential, offering investors a chance to capitalize on the expected growth in the copper market.

TGB Stock Price Outlook

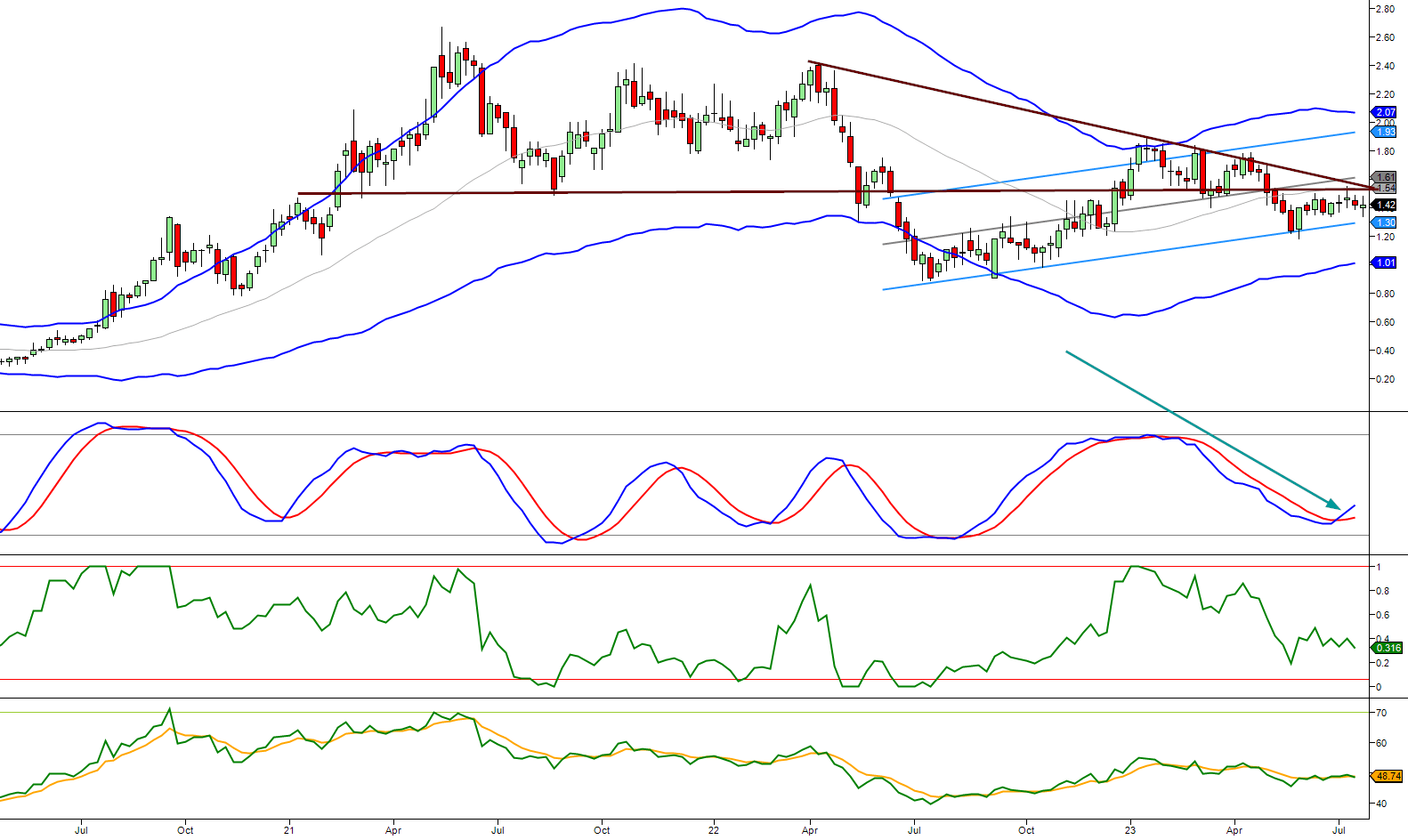

From a technical perspective, the stock has ample potential to continue its upward trajectory. The weekly chart indicates that TGB is currently trading in the oversold range, suggesting room for further growth. Similarly, the monthly chart echoes this sentiment. However, it is worth noting that TGB is encountering resistance within the 1.50 to 1.55 range. A significant breakthrough would occur with a weekly close at or above 1.50, preferably surpassing 1.55. Such a development would signal a new breakout and potentially propel TGB to even greater heights. Tactical Investor Update Jan 21, 2024

It successfully closed above $1.55 on a weekly and monthly basis, leading to a strong rally as predicted. Trading exceeded $2.80 before retracing. This validates the importance of patience and discipline, key principles we consistently emphasize for long-term success.

At this game stage, it makes sense to wait for it to consolidate before considering entry. Ideally, a drop to the $1.80 to $1.90 range would present a good opportunity. Overall, we anticipate TGB trading well past $5.50 in the months ahead. Strong pullbacks should be embraced, and if copper shortages persist as projected, TGB could be trading north of $7.20 before reaching a long-term peak.

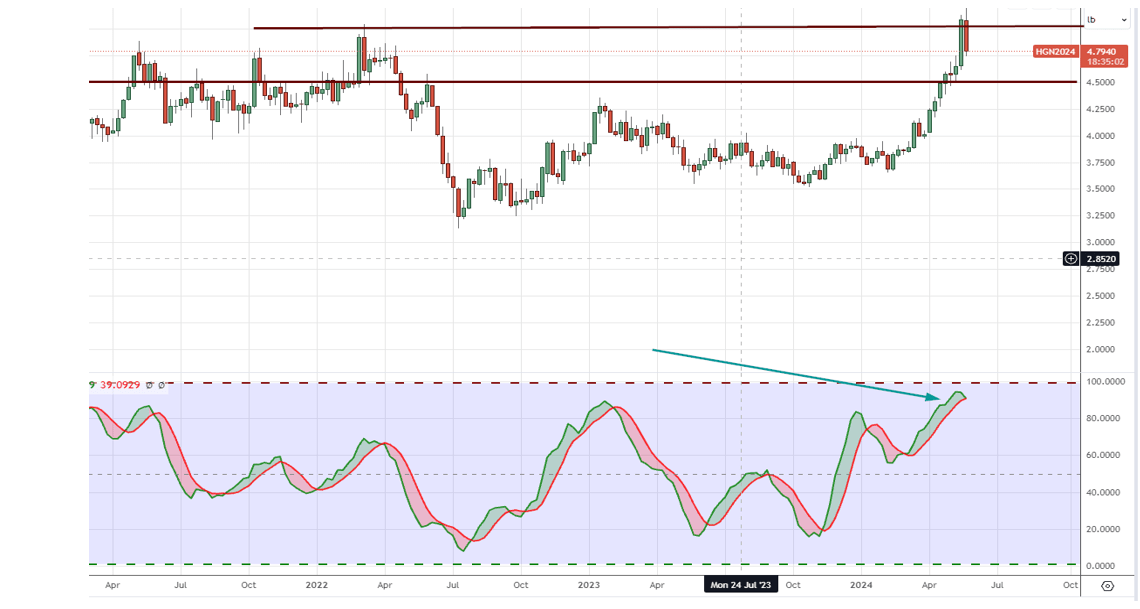

Copper’s long-term outlook remains positive if it stays above $1.90. It can achieve substantial upward momentum if it achieves a weekly close above $3.90 or a monthly close at $4.20, possibly reaching the $6.50 plus range. Tactcal Investor June 2024

Forecasting TGB: Price Targets and Long-Term Projections

In the copper sector, TGB stands out as one of the underperformers, currently falling under the category of a “dog.” However, every dog eventually has its day in the sun. Despite positive earnings and future prospects, it struggled to close at or above 1.50 on a weekly basis – a milestone it recently achieved. A more significant development would be a close at 1.55 or better. TGB’s price action could serve as an early signal for copper. If TGB manages to surge to 1.80, it would be a very bullish long-term development. Market update February 19, 2024

TGB has surged past 1.80, signalling two significant long-term trends. First, the developed world will be scrambling for copper, caught off guard, and paying a heavy price for their oversight. Second, the developing world, backed by Russia and China, will weaponize copper, eventually shipping only the finished product rather than the ore.

On a side note, France will likely be ousted from New Caledonia sooner rather than later, mirroring a global trend where Western-installed corrupt regimes are overthrown, cutting off access to cheap resources.

TGB finally closed at or above 1.50, breaking out strongly after repeated failures and managing to close above 1.80. This breakout is particularly significant as TGB was previously a laggard in the sector. The positive breakout augurs well for the long-term prospects of the sector. TGB is projected to eventually trade at least 100% higher from its May 21 close of 2.67, with the possibility of surpassing 7.50. However, it’s important to maintain discipline and never overinvest in any given play. Market Update April 3, 2024

TGB is still projected to trade to and beyond 7.50 eventually. Surprisingly, despite its strong run-up, copper trades in the neutral zone on the monthly charts, indicating significant upside potential. At this stage, patience is required as the technical indicators must pull back into the oversold zone.

Copper is currently trading in the highly overbought range on the weekly charts. While a strong pullback isn’t necessary, a sharp one would be welcomed. The critical factor is for copper to reach an oversold state. Once this occurs, we will aggressively open positions in 3-4 copper companies.

Taseko Mines: Copper’s Rising Star in a Shifting Market

Despite short-term market fluctuations, Taseko Mines stands poised to capitalize on copper’s long-term bullish outlook. The International Copper Study Group (ICSG) forecasts a potential 467,000 metric ton surplus in 2024, but don’t be fooled – this metal’s future still shines bright.

The World Bank projects a steady 1.9% annual growth in copper demand through 2030, fueled by the electric vehicle (EV) revolution and renewable energy boom. Taseko’s assets are primed to meet this surge:

1. Gibraltar Mine: Canada’s second-largest open-pit copper mine, boasting a whopping 3.2 billion pounds of proven and probable reserves.

2. Florence Copper Project: Set to churn out 85 million pounds of copper annually for 21 years.

The EV tsunami is coming. The International Energy Agency predicts 145 million EVs on roads by 2030, up from a mere 11 million in 2020. Each of these copper-hungry beasts needs wiring, batteries, and charging infrastructure.

Don’t forget renewables – wind turbines and solar panels are copper gluttons, gobbling up the metal for transmission lines and energy storage.

Taseko isn’t just riding the wave – it’s positioning itself to dominate. This company holds the keys to copper’s kingdom in a market where supply struggles to keep pace with insatiable demand.

Taseko Mines: Copper Powerhouse in the Making

Taseko Mines is positioning itself as North America’s next mid-tier copper producer, leveraging its assets to meet the surging global demand for the red metal. The company’s strategy revolves around two key projects:

1. Gibraltar Mine: Canada’s second-largest open-pit copper mine, boasting a daily processing capacity of 85,000 tons and reserves of 640.5 million tonnes grading 0.25% copper. Taseko’s recent acquisition of an additional 12.5% stake, bringing its total ownership to 87.5%, is set to boost annual copper production by 30 million pounds and cash flow by C$60-70 million.

2. Florence Copper Project: Arizona’s innovative in-situ recovery operation promises 85 million pounds of copper annually over 21 years, with minimal environmental impact. The project recently secured its final EPA permit, green-lighting commercial production.

Taseko’s Q3 2023 performance showcased a 9% quarter-over-quarter increase in copper production, hitting 24.1 million pounds. With the global copper market tightening and demand for clean energy technologies soaring, Taseko is primed to capitalize on the metal’s bullish outlook.

Global Copper Market: Deficit Looms in 2024

The copper market is bracing for a seismic shift in 2024. Goldman Sachs has thrown down the gauntlet, forecasting a deficit exceeding 500,000 tons – a stark reversal from previous surplus predictions. This dramatic turnaround stems from production cuts and operational hiccups in Latin America’s copper heartland.

Industry giants are feeling the squeeze:

– Anglo-American slashed its 2024 copper target by 200,000 tons, effectively erasing a large mine’s worth of supply.

– Vale lowered its production guidance, further tightening the market.

BMO Capital Markets, once bullish on a surplus, now predicts a small deficit. Macquarie Bank raised its Q3 2024 price floor from $7,600 to $8,000 per ton, acknowledging the market’s newfound tightness.

China’s resurgent appetite for copper, fueled by property sector support and easing COVID restrictions, is set to drive demand. Given its critical role in clean energy technologies, Goldman Sachs crowns copper as the prime beneficiary of these policy shifts.

Antofagasta’s CEO, Iván Arriagada, projects a 2024 deficit between 200,000-300,000 tons. Fastmarkets analyst Boris Mikanikrezai paints a similar picture, forecasting 1.5% growth in global refined copper production against a 2.6% surge in demand.

The copper market is coiling like a spring, ready to unleash potential price surges as supply struggles to keep pace with voracious demand. Investors take note – the red metal’s future looks electrifying.

Conclusion

The global copper market’s projected deficit in 2024 is not just a matter of supply and demand; it’s also influenced by various psychological factors that shape market behaviour.

The shift from an expected surplus to a deficit, driven by production cuts and operational issues in Latin America, demonstrates how quickly market perceptions can change. This rapid shift in outlook could trigger a bandwagon effect, where investors and traders rush to adjust their positions based on the new consensus, potentially amplifying price movements.

The revised forecasts by major institutions like Goldman Sachs and BMO Capital Markets highlight the role of anchoring bias in market analysis. Initial predictions can significantly influence subsequent estimates, even as new information becomes available. Macquarie Bank’s adjustment of price forecasts, raising its projected low from $7,600 to $8,000 per ton, illustrates how analysts must constantly recalibrate to avoid being anchored to outdated predictions.

China’s expected demand rebound showcases the impact of herd behaviour in markets. As positive sentiment about China’s economic recovery grows, it could lead to a self-reinforcing cycle of increased investment and higher copper prices. This phenomenon is often exacerbated by confirmation bias, where market participants selectively interpret information confirming their beliefs about market trends.

The growing focus on copper’s role in clean energy technologies demonstrates how **narrative bias** can influence market perceptions. The compelling story of copper as a critical component of the green economy transition could lead investors to overemphasize this factor, potentially overlooking other essential market dynamics.

As the copper market navigates these complex dynamics, investors and analysts must be aware of these psychological factors. Recognizing cognitive biases and mass psychology effects can lead to more balanced analysis and decision-making in the face of market uncertainty.